Executive Summary

Canada has entered a period of deliberate moderation in its immigration planning. The 2025 Annual Report to Parliament on Immigration, Budget 2025, and the newly released 2026–2028 Immigration Levels Plan collectively mark a shift from expansion to sustainability.

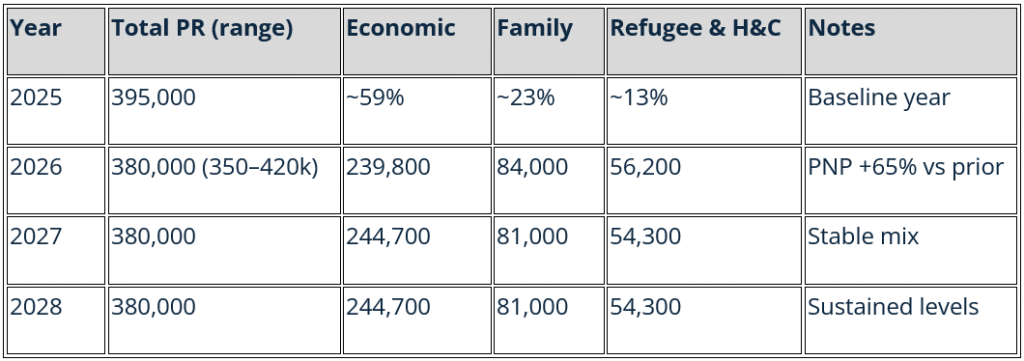

Permanent-resident (PR) admissions will stabilize at 380,000 per year from 2026 through 2028, down from 395,000 in 2025, while temporary-resident (TR) arrivals will decline to 385,000 in 2026 and 370,000 in 2027–2028.

The plan aims to reduce Canada’s temporary-resident population to below 5 percent of the total population by the end of 2027 (down from roughly 7.5 percent in 2024), increase the economic-immigration share to 64 percent, and expand Francophone admissions outside Quebec to 10.5 percent by 2028, advancing toward the federal target of 12 percent by 2029.

Two one-time transition initiatives will grant permanent residence to up to 33,000 work-permit holders (2026–2027) and approximately 115,000 Protected Persons already in Canada.

The plan also introduces a forthcoming accelerated pathway for H-1B visa holders and top global researchers, with a goal of attracting over 1,000 leading researchers and advanced-industry specialists to Canada.

1. Review of 2025: Context and Lessons Learned

The 2025 period was characterized by rapid intake pressures and the beginning of a deliberate shift toward stabilization.

The Annual Report to Parliament on Immigration (2025) emphasized “restoring control” by aligning immigration intake with Canada’s housing, infrastructure, and service capacity, while sustaining economic growth and humanitarian commitments.

Key indicators for 2025:

- Permanent residents admitted: 395,000 (target) – approximately 483,640 actual admissions (58% economic class)

- Temporary residents: Over 1.6 million permits issued; approximately 3 million individuals held valid status

- Study permits: Down 24% under new attestation and cap system

- Work permits: Down 4% compared to 2023

- Transitions: 160,100 workers and 25,580 students obtained PR

These results demonstrated both the strength of domestic transition pathways and the need for structural limits to balance infrastructure and labour absorption.

2. 2026–2028 Immigration Levels Plan: Key Directions

Major Adjustments and Observations

- Provincial Nominee Program (PNP): Target rises sharply to 91,500 in 2026, up from 55,000 in the prior plan, the largest single increase across all programs.

- Express Entry: Reduced from 122,830 to 109,000; IRCC no longer distinguishes between CEC and category-based draws.

- Federal Business Programs: Cut by 50%, down to 500 admissions.

- Parents and Grandparents Program: Reduced from 21,500 to 15,000.

- Humanitarian & Compassionate: Falls to 1,100 admissions.

- Refugees and Protected Persons: Decline from 55,300 to 49,300, though partially offset by one-time regularizations.

Apart from the PNP expansion, 2026 is shaping up to be as competitive as 2025, if not slightly more so, particularly in federal programs.

Possible Undercounting

IRCC’s Budget 2025 and Levels Plan describe two “one-time initiatives” outside official plan totals:

- 115,000 Protected Persons (2026–2027), and

- 33,000 temporary residents transitioning to PR.

Because the official plan accounts for only ~40,000 asylum-related admissions, actual PR admissions in 2026–2027 could exceed official targets by up to 148,000.

Quantitative Overview

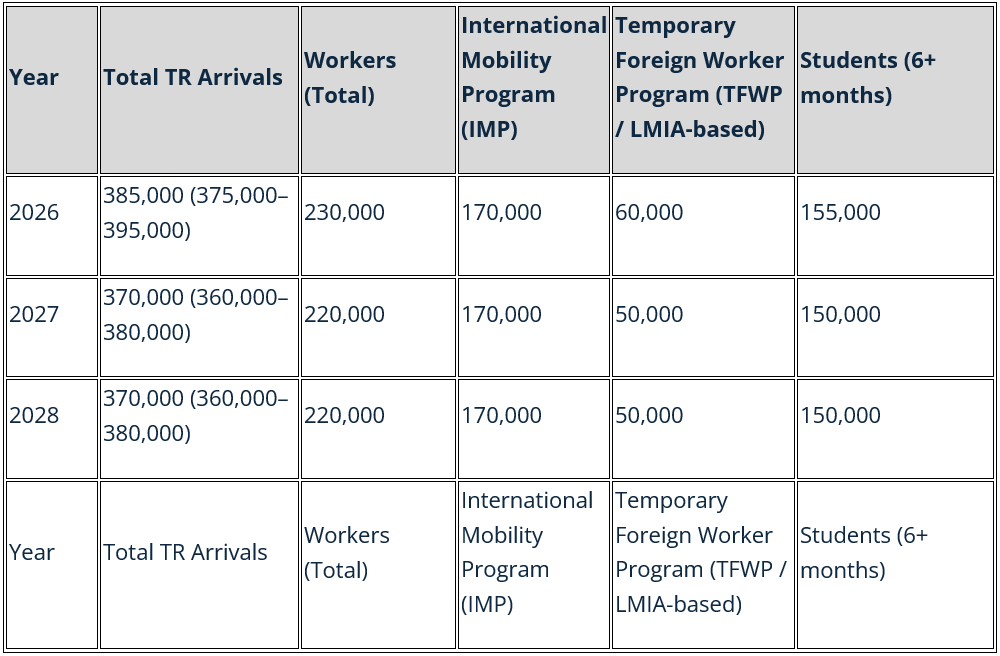

2A. Temporary Resident Breakdown and Analysis (2026–2028)

The 2026–2028 Levels Plan introduces for the first time explicit targets for new temporary resident arrivals under both worker and student categories. These figures represent new arrivals only, not extensions or in-Canada permit changes.

Interpretation:

- The International Mobility Program (IMP), which includes LMIA-exempt categories such as intra-company transfers, open work permits, and trade-agreement mobility, continues to dominate, representing about three-quarters of all new temporary workers.

- The Temporary Foreign Worker Program (TFWP / LMIA-based) allocation declines from 60,000 to 50,000 by 2027, reflecting stricter control and stronger employer accountability.

- Study permits remain capped at 150,000–155,000 new arrivals per year, continuing the downward adjustment introduced in 2024–2025.

- Combined, these measures aim to bring Canada’s overall temporary population to under 5% of the national total by the end of 2027, down from roughly 7.5% in 2024.

This represents a clear policy shift from quantity to sustainability, with more scrutiny on employer use of temporary programs and greater emphasis on transitioning skilled foreign workers already in Canada to permanent residence.

3. One-Time and Targeted Initiatives

- Work-Permit Holder Transition: Up to 33,000 temporary workers to PR (2026–2027).

- Protected Persons Transition: Approximately 115,000 individuals (2026–2027).

- Regional Targeting: Emphasis on rural and tariff-affected industries.

- H-1B Talent and Research Pathway: Accelerated program to attract over 1,000 researchers and advanced-industry specialists, enhancing Canada’s global innovation and competitiveness.

4. Greenberg Hameed PC Analysis

Employers

The sharp rise in PNP allocations represents a significant shift of control to provincial governments. Employers should strengthen partnerships with provincial authorities and embed permanent residence (PR) retention strategies into workforce planning.

Those relying on LMIA-based hiring under the TFWP will face tighter oversight as allocations drop from 60,000 to 50,000, and can expect enhanced compliance and integrity reviews through 2025–2026.

This may also create opportunities for employers seeking to transition foreign talent from temporary to permanent residence status.

With expanded provincial quotas and targeted transition pathways, employers who align recruitment and sponsorship practices with these programs can retain skilled workers and reduce future labour-market uncertainty.

High-Skill and Research Recruitment

The introduction of an H-1B and researcher-focused stream, aimed at over 1,000 international researchers and specialists, highlights a pivot toward innovation-driven migration. Canadian employers in health sciences, technology, and advanced manufacturing should prepare to engage this pathway once operational details are published.

Applicants and Temporary Residents

For applicants, 2026 will likely remain highly competitive.

Those already in Canada will continue to benefit most from category-based and transitional pathways, while international students and post-graduation work permit holders should anticipate narrower program eligibility and stricter intake limits.

5. Systemic Constraints

Neither the 2026–2028 Plan nor Budget 2025 provides new funding to reduce processing times or refusal rates.

No significant IRCC modernization or staffing expansion is announced.

One-time transitions and regular intakes may strain system capacity in the near term.

6. Broader Direction and Takeaways

Canada’s 2026–2028 plan represents a transition from volume to sustainability.

Policy priorities now emphasize integration capacity, infrastructure readiness, and economic alignment.

Employers must transition from short-term foreign recruitment toward structured PR retention strategies for existing workers.

Temporary residents and students already in Canada will remain the principal source of future PR candidates.

For overseas applicants, competition will tighten and wait times may increase.

7. Next Steps from Greenberg Hameed PC

As further information becomes available, Greenberg Hameed PC will publish updated analyses on:

- Operational details for the H-1B and researcher pathways;

- Implications of Bill C-12 for immigration processing and governance;

- Employer compliance and LMIA strategy under revised allocations; and

- Implementation of one-time transition initiatives.

The firm will continue to assist employers, aspiring immigrants, and temporary residents in assessing eligibility, optimizing workforce strategies, and anticipating the operational impacts of the 2026–2028 Immigration Levels Plan.

Canada’s Immigration Plan 2026 — Strategic Overview and Implications for Employers and Applicants

(All information derived from official Government of Canada and IRCC sources: Annual Report to Parliament on Immigration 2025, Immigration Levels Plan 2026–2028, IRCC Corporate Mandate, and Budget 2025 – “Canada Strong.”)

I. The Immigration Plan and Overview

1) How have overall permanent-resident (PR) targets changed from 2025 to 2026?

Facts:

2025 PR target: 395,000. 2026 PR target: 380,000 (a reduction of 15,000 or –3.8 %).

Commentary:

IRCC is signalling a pivot from rapid expansion to stabilization and system efficiency. The adjustment provides space to address processing backlogs and infrastructure capacity.

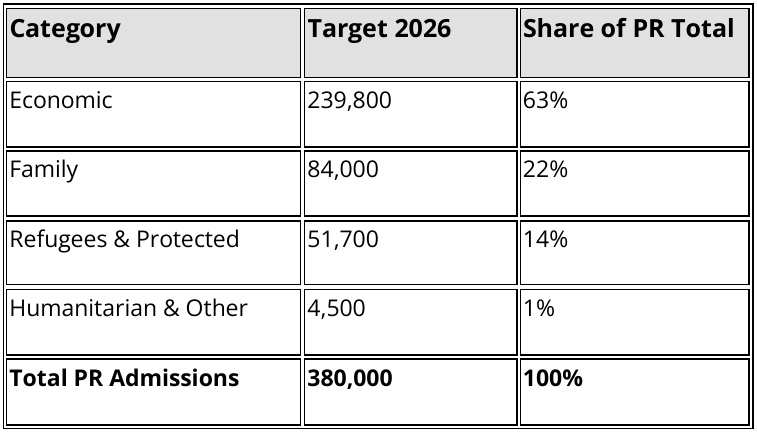

2) What is the composition of the 2026 plan by category?

Facts:

Economic: 239,800 (63 %) | Family: 84,000 (22 %) | Refugees & Protected: 51,700 (14 %) | Humanitarian & Other: 4,500 (1 %).

Commentary:

The economic class continues to dominate, reinforcing immigration’s role as a driver of workforce and productivity growth while sustaining family and humanitarian commitments.

3) How will the 2026 economic target be filled?

Facts:

Federal High-Skilled (Express Entry) ≈ 109,000; Provincial Nominee Program (PNP) ≈ 91,500; Business/Regional Streams ≈ 6,000.

Commentary:

Canada continues to rely on Express Entry and PNP as its main selection vehicles, both increasingly sourcing candidates already working or studying within Canada.

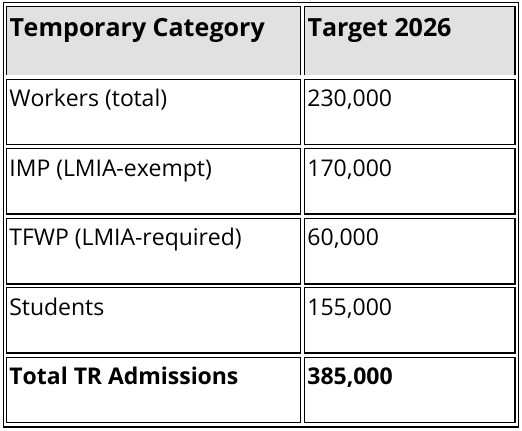

4) What are the planned temporary-resident (TR) admissions for 2026?

Facts:

Total TR inflows: 385,000 – 230,000 workers and 155,000 students.

Commentary:

TR intake moderation reflects a housing- and infrastructure-conscious approach while maintaining a strong pipeline of labour and talent.

5) How are temporary workers split by program type?

Facts:

International Mobility Program (LMIA-exempt): 170,000; Temporary Foreign Worker Program (LMIA-required): 60,000.

Commentary:

Roughly three-quarters of temporary workers are LMIA-exempt, demonstrating the growing reliance on mobility, trade, and intra-company pathways.

6) What one-time transition measures are included (2026–2027)?

Facts:

Fast-track of 33,000 skilled temporary workers to PR status and 115,000 protected persons to PR.

Commentary:

These targeted conversions stabilize labour markets by transitioning integrated individuals into the permanent system.

7) How does the plan balance temporary and permanent flows?

Facts:

The Levels Plan emphasizes in-Canada transitions while capping TR inflows at 385,000.

Commentary:

Canada is moving toward conversion over expansion, converting talent already contributing to the economy into permanent residents.

8) What direction does Budget 2025 give?

Source:

Budget 2025 – “Canada Strong.”

Commentary:

Budget 2025 integrates immigration with housing and productivity strategies, confirming immigration’s economic centrality while prioritizing sustainable absorption.

9) 2026 targets at a glance

Facts:

Commentary:

2026 acts as a recalibration year, maintaining high PR admissions but managing TR inflows to balance growth with capacity.

II. The Immigration Plan and Employers

1) How will the 2026 plan influence employer access to skilled workers?

Facts:

Economic-class admissions total 239,800 (63 % of overall immigration).

Commentary:

Employers can expect consistent access to skilled talent under category-based Express Entry draws focused on sectors such as healthcare, STEM, and trades.

2) How will the Provincial Nominee Program support employers in 2026?

Facts:

PNP admissions will reach ≈ 91,500.

Commentary:

The PNP continues to expand as the key vehicle for regional workforce strategies, allowing employers to nominate in-demand workers directly.

2A) Evaluate the opportunities for employers to transition skilled temporary workers to permanent resident status in light of the significant PNP allocations.

Facts:

The 2026 PNP target is 91,500, and a federal measure will convert 33,000 temporary workers to PR.

Commentary:

Employers can capitalize on expanded provincial allocations to secure PR for existing staff, improving retention and reducing turnover. Early coordination with provincial programs and detailed documentation of employment roles will optimize nomination outcomes.

3) What does the one-time 33,000 TR/PR transition mean for employers?

Facts:

Federal initiative to fast-track 33,000 skilled temporary workers to PR between 2026–2027.

Commentary:

This program helps employers retain proven staff, ensuring continuity without restarting costly recruitment.

4) How will temporary-worker admissions support short-term labour needs?

Facts:

Total temporary workers in 2026: 230,000 (170,000 IMP / 60,000 TFWP).

Commentary:

This balanced approach supports agility through the IMP while maintaining targeted LMIA-based recruitment for verifiable shortages.

4A) How are employers impacted if they pursue LMIA-based hiring versus IMP (LMIA-exempt) options?

Facts:

Approximately 74 % of temporary workers will arrive via LMIA-exempt programs.

Commentary:

LMIA-based hiring under the TFWP remains more compliance-intensive. IMP pathways, covering intra-company transfers, trade agreements, and reciprocal arrangements, offer faster, lower-burden access but require strong documentation. Government policy favours LMIA-exempt flexibility where legitimately applicable.

5) How does Budget 2025 relate to employers and labour supply?

Source:

Budget 2025 – “Canada Strong.”

Commentary:

The budget links immigration to training and housing capacity, emphasizing sustainable labour growth in line with infrastructure limits.

6) Employer implications summary

Facts:

Economic 239,800 | PNP 91,500 | TR/PR 33,000 | Temporary 230,000 (IMP 170,000 / TFWP 60,000).

Commentary:

Employers operate within a dual framework: 1) Permanent recruitment through Express Entry and PNP; 2) Short-term mobility via IMP and TFWP. Those prioritizing long-term transition of foreign workers will gain the most stability.

III. The Immigration Plan and Temporary Residents Seeking Permanent Status

1) How have PR targets changed from 2025 to 2026?

Facts:

PR intake reduced from 395,000 to 380,000.

Commentary:

A modest decrease reflects an intent to consolidate operations and focus on domestic transitions.

2) How has the immigrant-class mix shifted?

Facts:

Economic class increased to 63 % of total admissions.

Commentary:

This reflects an emphasis on high-value economic migrants, many already in Canada.

3) How have total TR admissions changed?

Facts:

Capped at 385,000, lower than 2025 levels.

Commentary:

This moderation redirects processing capacity toward permanent pathways.

4) TR mix: workers vs students (2026)

Facts:

Workers 230,000 | Students 155,000.

Commentary:

The shift toward workers reduces reliance on study permits and favours candidates contributing to the labour market.

5) Worker mix: LMIA-exempt vs LMIA-required (2026)

Facts:

IMP 170,000 | TFWP 60,000.

Commentary:

The ongoing preference for IMP pathways streamlines mobility and encourages reciprocity with trade partners.

6) How will the PR plan be filled across programs?

Facts:

Federal High-Skilled 109,000 | PNP 91,500 | Business/Regional ≈ 6,000.

Commentary:

Most new PRs will come from candidates already in Canada, reinforcing the in-Canada transition strategy.

7) How are in-Canada work-permit holders counted once they become PR?

Facts:

Counted as new PRs at the time of landing under their assigned category.

Commentary:

This method means many “new arrivals” are actually conversions of existing residents.

8) Inside vs. outside Canada Express Entry split (2026)

Source:

Immigration Levels Plan 2026–2028.

Commentary:

Although not numerically stated, policy direction suggests a majority of Express Entry landings will be from individuals already living and working in Canada.

9) Who fits the one-time 33,000 TR/PR transition (2026–27)?

Facts:

Applies to skilled temporary workers contributing to Canada’s economy and communities.

Commentary:

Likely includes PGWP holders and high-skill IMP/TFWP workers demonstrating proven integration.

10) Will provinces participate in these transitions?

Facts:

The 33,000-person program is federal; provinces continue separate PNPs.

Commentary:

These mechanisms work in parallel, broadening access to permanent status for in-Canada talent.

11) How will Digital Platform Modernization affect TR/PR applicants?

Source:

Annual Report to Parliament on Immigration 2025.

Commentary:

DPM will automate file completeness and streamline processing, improving timelines for in-Canada applicants.

12) Could automation or AI affect fairness or outcomes?

Source:

Treasury Board Directive on Automated Decision-Making (2023).

Commentary:

IRCC must retain human oversight and transparency. Future automation must enhance efficiency while preserving applicants’ procedural rights.

IV. The Immigration Plan and Compliance

1) How will employer-inspection responsibilities change under Budget 2025?

Source:

Budget 2025 – “Canada Strong.”

Commentary:

No explicit inspection reforms are outlined, but modernization points toward tighter data-sharing and harmonized oversight between IRCC and ESDC.

2) How will Digital Platform Modernization improve compliance oversight?

Facts:

The Annual Report 2025 confirms DPM will unify digital systems, linking application data and employer records.

Commentary:

This integration will automate compliance verification and improve real-time tracking of employer obligations while retaining human review.

3) Could AI integration under DPM influence compliance reviews?

Source:

Annual Report to Parliament on Immigration 2025; Immigration Levels Plan 2026–2028; Budget 2025 – “Canada Strong.”

Commentary:

Although no explicit AI plan exists, analytics may eventually flag irregularities. Transparency and auditability will be crucial to maintain fairness.

4) How will IRCC manage backlogs with fewer officers?

Facts:

The 2026–2028 plan stabilizes PR at 380,000 and TR at 385,000; no staffing changes announced.

Commentary:

IRCC is relying on intake control and digital automation to balance caseloads, prioritizing electronic submissions for efficiency.

5) What are 2025 backlog figures by major category?

Facts:

External IRCC dashboards indicated about 2.2 million applications mid-2025, roughly 40 % beyond service standards.

Commentary:

Stabilized levels through 2028 aim to reduce these inventories before further expansion.

6) What compliance issues should employers monitor?

Source:

Annual Report to Parliament on Immigration 2025; Immigration Levels Plan 2026–2028.

Commentary:

Employers should expect stronger electronic record-keeping, automated completeness checks, and cross-program audits using shared data.

7) How might modernization affect procedural fairness?

Facts:

Governed by the Treasury Board Directive on Automated Decision-Making (2023).

Commentary:

IRCC must maintain human review and provide transparency and appeal mechanisms to safeguard fairness as automation expands.

For comprehensive legal analysis or strategic case support, contact Greenberg Hameed PC.

The content of this bulletin is for informational purposes only, and is not intended to provide or be relied on as legal advice.